Marginal tax calculator

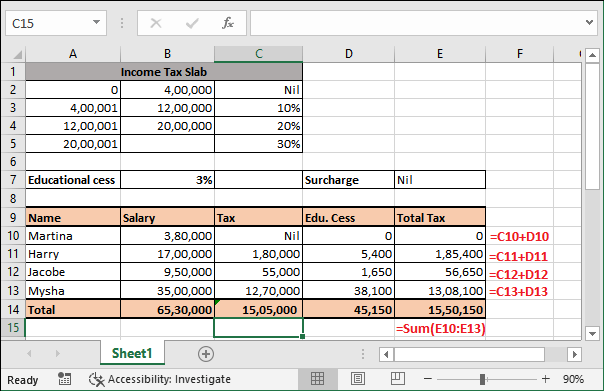

MPG Marginal Propensity of Government Expenditures. Normal tax liability ie.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

This marginal tax rate means that your immediate additional income will be taxed at this rate.

. X Filing status Choose your filing status. You may also look at the following articles to learn more. Calculator disclaimers and assumptions can be found under each calculator.

A public limited automobile company manufactured 348748 units of vehicles includes MHCV LCV Utility Therefore Marginal cost 57312 which means the. Press spacebar to hide inputs -. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

So for contractors earning 50000 have entered the higher rate tax band and their marginal rate of income tax is 40 because the contractor will be paying 40 on the next pound earned. Calculate your combined federal and provincial tax bill in each province and territory. The line in question is the adjusted gross income AGI of the taxpayer and is the bottom number on the.

This will help you calculate your tax liability for unexpected income retirement planning or investment income. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. In most cases your employer will deduct the income tax from your wages and pay it to the ATO.

Let us say that company X is producing five hundred units of masks at the cost of 10000 rupees. Marginal cost can be calculated by dividing the change in total cost by the change in quantity. The calculator reflects known rates as of June 15 2021.

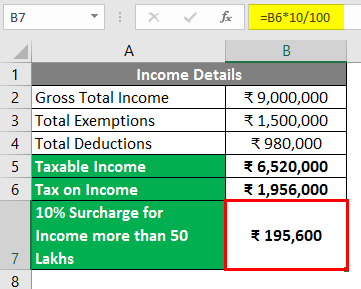

You can reduce your Corporation Tax bill by claiming Marginal Relief if your companys profits before 1 April 2015 were between 300000 and 15 million. These add up to 040 per gallon of beer 076 per gallon of wine and 303 per gallon of distilled spirits. 3293750 will be the tax liability before cess.

Refer to these for more information. And below-the-line BTL itemized deductions which reduce tax based on the marginal tax rate. How Income Taxes Are Calculated.

Total tax liability will be computed as follows. This marginal tax rate means that your immediate additional income will be taxed at this rate. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399.

However An Online Income Tax Calculator helps to estimates the refund or potential owed amount. Your average tax rate is 217 and your marginal tax rate is 360. For instance an increase of S100 in your salary will be taxed S1150 hence your net pay will only increase by S8850.

Marginal cost 6000 5000 1500 1000 Marginal cost 2 which means the marginal cost of increasing the output by one unit is 2. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll. Without marginal relief comes to Rs.

This calculator shows marginal rates for the. If you find errors - let us know so we can fix them email us at infouktaxcalculatorscouk. Province Tax Payable After-Tax Income Average Tax Rate Marginal Tax Rate Marginal Rate on Capital Gains Marginal Rate on Eligible Dividends Marginal Rate.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. Marginal Cost Formula Example No 2. These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. MPT Marginal Propensity to Tax. Here we discuss how to calculate tax multiplier along with practical examples.

Use this calculator to help estimate your income tax rate tax bracket and marginal tax rate for the current year. This calculator checks the Corporation Tax on the Gross Profit figure you provide. The calculator reflects known rates as of June 1 2022.

The definition of the marginal rate of tax paid is the percentage of tax paid on earnings for the next pound earned. All company sizes work - small or main rate - any marginal relief is applied for you. 2022 Personal tax calculator.

We also provide a tax multiplier calculator with a downloadable excel template. Louisianas state cigarette tax of 108 per pack of 20 cigarettes. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Province Tax Payable After-Tax Income Average Tax Rate Marginal Tax Rate Marginal Rate on Capital Gains Marginal Rate on Eligible Dividends Marginal Rate. It can be observed that tax liability under marginal relief is lower and hence Rs.

For instance an increase of 100 in your salary will be taxed 3955 hence your net pay will only increase by 6045. 2021 Personal tax calculator. In addition to sales taxes alcohol in Louisiana faces additional excise taxes.

2022 Marginal Tax Rates Calculator. Your average tax rate is 212 and your marginal tax rate is 396. Marginal Tax Rate Calculator for 2017.

Marginal tax rate calculator. Your household income location filing status and number of personal exemptions. Your average tax rate is 314 and your marginal tax rate is 384.

MPI Marginal Propensity to Invest. Refer to these for more detailed information about how a specific calculator works. 3303375 and tax liability under marginal relief comes to Rs.

For instance an increase of 100 in your salary will be taxed 3843 hence your net pay will only increase by 6157. Your average tax rate is 215 and your marginal tax rate is 115. In partnership with your tax professional an Ameriprise advisor can help minimize the.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Louisiana Cigarette Tax. Skip To The Main Content.

This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. Find out your marginal tax rate. Calculate your combined federal and provincial tax bill in each province and territory.

Calculator frequently asked questions can be found under most calculators.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Calculating Formula In Excel Javatpoint

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

State Corporate Income Tax Rates And Brackets Tax Foundation

Taxable Income Formula Calculator Examples With Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Marginal Tax Rate Bogleheads

Self Employed Tax Calculator Business Tax Self Employment Employment

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Marginal Tax Rate Formula Definition Investinganswers

Income Tax Calculating Formula In Excel Javatpoint

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Income Tax Calculating Formula In Excel Javatpoint

Komentar

Posting Komentar