31+ ideal mortgage to income ratio

Ad Find Deals on calculator mortgage in Calculators on Amazon. Ad Learn More About Mortgage Preapproval.

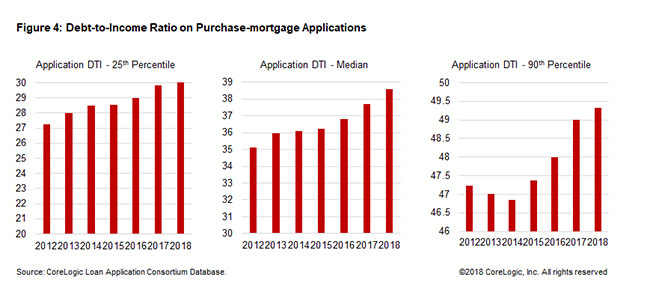

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

Average mortgage rates vary from day to day and the rate youre offered will depend on your down payment credit score debt and income.

. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Ad It Only Takes Minutes to See What You Qualify For. Check Official USDA Loan Requirements re Eligible for No PMI 0 Down More.

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Browse Information at NerdWallet. Web To calculate your DTI ratio add up your recurring monthly debt payments including credit card student loan mortgage auto loan and other loan payments and divide the sum.

Debt To Income Ratios Home Tips For Women Ideally. 1 2 For example assume. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment.

Use our DTI calculator to. Take Advantage And Lock In A Great Rate. A higher ratio could mean youll pay more interest or be denied a loan.

Ad Learn More About Mortgage Preapproval. Web A good DTI ratio to get approved for a mortgage is under 36. Heres how lenders typically view DTI.

For example if you owe 1000 for your monthly. Browse Information at NerdWallet. Ad Easier Qualification And Low Rates With Government Backed Security.

Web Web Use this simple formula to find your debt-to-income ratio. Use NerdWallet Reviews To Research Lenders. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Take Advantage And Lock In A Great Rate. Ad See what your estimated monthly payment would be with the VA Loan.

Web To calculate your DTI add up all your monthly debt payments and divide that total by your gross monthly income. Save Real Money Today. Use NerdWallet Reviews To Research Lenders.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

50 is a common limit but some lenders are more cautious.

:max_bytes(150000):strip_icc()/aging-schedule_final-d245d5e6c45d42c48e56f2892ab014f8.png)

Aging Schedule Definition How It Works Benefits And Example

Homes Land Of The Smokies Vol 31 Issue 9 By Homes Land Of Tennessee Issuu

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Pmc Fha 580 Fico 43 47 Debt To Income Ratio Can Be Combined With Down Payment Assistance Fha Loans Mortgage Help Mortgage Companies

Percentage Of Income For Mortgage Payments Quicken Loans

Capital Funding 6 Examples Format Pdf Examples

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1915 Session I Education Higher Education In Continuation Of

Lbcer8kex992 2020q4

Help How Do I Sell My House In Negative Equity

Capping Debt To Income Ratios Complementary To Housing Loan Cap Bank Of Finland Bulletin

Low Income Student Loans Financial Aid Options Sofi

Final Directtaxlaw Practice Pdf Income Tax Tax Deduction

31 Money Receipt Templates Doc Pdf

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford Calculator Cnet Cnet

Mortgage Income Calculator Nerdwallet

Mortgage Broker In Birkdale Thornside Wakerley Mortgage Choice

Komentar

Posting Komentar